Use Cases

-

Customer Support

-

Payment Services

-

Customer Acquisition

-

Personalized Customer Experience

-

Client Onboarding

-

Customer Support1.4 M hours

saved with implementing the automated customer service tool Erica at Bank of America *

With the help of natural language processing and artificial intelligence, virtual assistants process the customer’s queries in just a few seconds with a personalized response. This is a big resource saver and makes it possible for the clients to receive an immediate and accurate response to their request over preferred channels, in multiple languages, 24/7.

Conversational AI in banking allows customers to simply ask for what they want: technical or account-related issues, or other customer support queries.

*Source: Bankautomation -

Payment Services89%

of consumers prefer mobile banking *

Conversational AI in banking provides consumers with alternative to access services outside of the classic mobile and web channels. With the help of chatbots, customers can execute self-service transactions like transfer of funds, payment of bills, set up autopay, check billing information, ask about fees, check balance, increase credit limit etc.

*Source: Insider Intelligence -

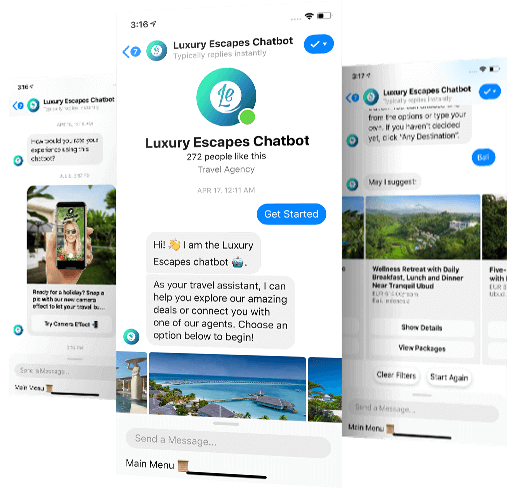

Customer Acquisition600%

growth in the number of potential customers generated using chatbots *

Using intelligent cues, a Virtual Assistant can call visitors’ attention to a financial services brand’s website, application, or other digital touchpoint by starting the conversation to discover if they want to purchase. The assistant offers information about relevant financial products and services, and prevents drop-offs by instantly addressing FAQs or transfers to the human agent.

While integrating with the CRM system, the team can add the prospects to the customer acquisition flow for further follow up activities until the sale is completed.

*Source: Economictimes -

Personalized Customer Experience80%

of consumers are more likely to buy when brands offer personalized experiences *

AI Assistant solution seamlessly integrates into the company’s Customer Relationship Management (CRM) or other back-end systems, instantly fetching data from that system, and making updates to the customer’s information based on the conversation – thus, allowing customers to receive highly personalised answers based on a wide range of factors such as previous purchases, preferences learned in conversation and geo-location.

*Source: Epsilon -

Client Onboarding27%

of the working week is spent on onboarding by over half of salespeople in banking *

AI driven customer onboarding process results notably in a drastic cost reduction for the banks and enhances the speed of customer onboarding, helping them at every step like a friend in need.

Just imagine an AI banking assistant that can walk a customer through the steps in the process of onboarding, adopting natural chatting in a digital channel. The bot can request documents, verify ID, fill out forms, make recommendations, talk users through processes, set up new accounts and much more while all of this remains automatic.

*Source: Gleif

Chatbot ROI Calculator

Run the numbers with our Chatbot ROI Calculator and get estimated results of the return you could get from implementing conversational Al across your business.

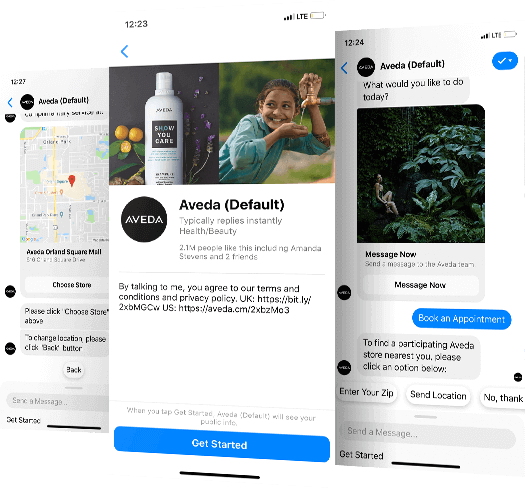

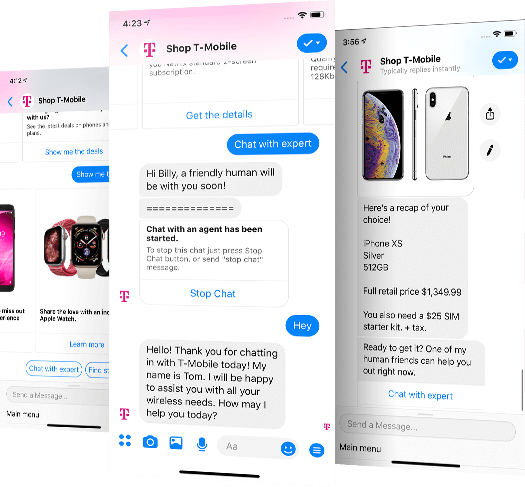

Calculate your potential ROIWe create AI chatbot services across channels

-

Messenger

1.56B daily active users

Easy to promote -

SMS

97% of smartphone owners use text messaging

-

WhatsApp

1.5B people use WhatsApp every month

-

Google Assistant

More than 1B devices worldwide

-

Alexa

100M devices with Alexa on board

-

Web and mobile chat

79% of consumers prefer Live Chat

Conversational AI Services

Master of Code Global provides an end-to-end list of services for any financial organization looking to enter or expand their conversational AI footprint.

- Conversational AI Strategy Consultancy

- Solution Review

- Conversation Design

- Finance Bot Development

- System Integration

Conversational AI Strategy Consultancy

Defining a conversational strategy is important for long-term success, but is also challenging. A solid strategy requires both knowledge of the business as well as the landscape in which you - and your competition - are playing.

A strategist will help you plan your vision, review your data, prioritize the right use cases, create a roadmap, identify the right channels, and more. With an understanding of the banking and financial services sector, Master of Code Global is prepared to guide you through creating the optimal AI strategy for your needs, and setting you up for continued growth and expansion as your needs and the landscape continues to evolve.

Get Started

Solution Review

You’ve already realized that a conversational AI solution is a strength for any financial services business to have, allowing your customers to self-serve. But how do you mature to the next level?

The first step in planning that next step is to review your current solution from top to bottom - from persona to the use cases; from the technology to the underlying platform.

Planning for the next stage requires an understanding of where you are at today, and the Conversational Experts at Master of Code can review what’s there today, document it, and provide inputs to help define the strategy for tomorrow and beyond.

Get Started

Conversation Design

The strength of any self-service tool is how it engages with the customer. Do you want a basic service that can only do a handful of things, or do you want a virtual assistant that can do as much as a branch advisor or teller?

Master of Code’s dedicated team of Conversation Designers can help you expand your customers’ experience with your chatbot or voice assistant, making the bot feel like and truly represent your brand and your services. From FAQ automation to checking your balance, making a bill payment to applying for a credit card…

Our Designers can help map out your conversational use cases, taking into consideration all of the details that need to be part of the process, helping design an experience that gives your users the control that they want and desire when banking with you.

Learn More

Finance Bot Development

Master of Code’s bot development team can do the entire solution build - top to bottom. We work with the leading bot and hosting providers - Microsoft, AWS, Google, LivePerson, Glia, and more! - to implement the right solution for what you need, working within the tools you have or recommending the ideal solution for your financial institution, based on your needs.

Get Started

System Integration

A major success factor with any virtual assistant is being able to provide the user the right information at the right time. Many banking services are spread out over multiple systems, some of which are in the cloud and others on-premise. And in some cases the ability for the systems to talk to one another can be a struggle.

Master of Code Global’s experience includes extensive integrations with many different systems. Building this bridge between disconnected systems will provide your users with more opportunity for self-service, allowing them to take ownership of their financial activities.

Get Started

Conversational AI in Financial and Banking Services

Master of Code Global empowers financial service companies to reap the benefits of using conversational AI solutions to increase customer satisfaction, retention, potential customers growth, and save time with processes that can be easily automated with AI-powered chatbots.

Get in Touch