Accountancy involves repetitive, detail-oriented, and often tedious tasks. It’s no surprise that global corporations like Deloitte, PwC, and EY are eagerly exploring Generative AI (Gen AI) to streamline their work. According to a KPMG report, 65% of financial reporting leaders use technology, with 49% having piloted or deployed intelligent solutions. This trend is accelerating, with 70% expecting broader rollouts within two years.

As artificial intelligence adoption grows, understanding its advantages and likely pitfalls is crucial. Moreover, this shift underscores the need for informed decision-making. To help you navigate technological innovation, we’ve created this guide with essential insights into its true potential. Let’s explore together how Generative AI in accounting can revolutionize your operations.

Table of Contents

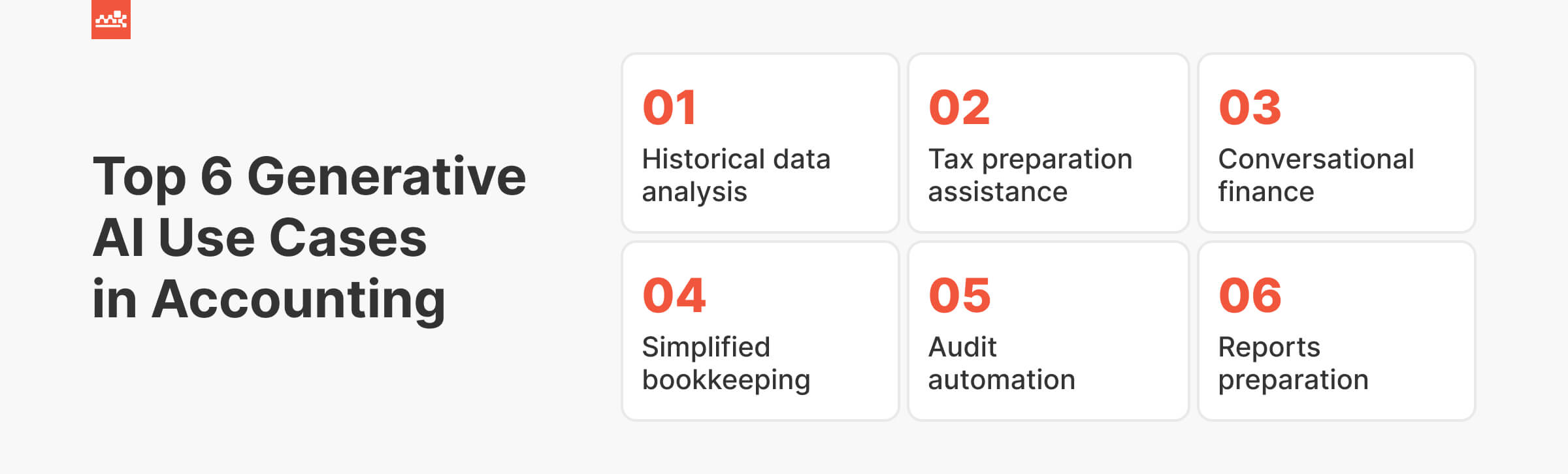

Practical Gen AI Applications in the Modern Accounting

Financial management is undeniably time-consuming and prone to human error. This reality can limit accountants’ ability to concentrate on higher-level analysis. Generative AI offers a solution by automating routine tasks, empowering specialists to shift their focus toward strategic advising.

Here are 7 exact ways niche professionals can benefit from artificial intelligence:

- Analyze historical data for better financial decision-making. Gen AI excels at reviewing datasets to pinpoint trends and patterns, enabling businesses to create more accurate and insights-driven forecasts.

- Assist in tax preparation. Accountants are updated on the latest fiscal policy and regulations. It can suggest potential deductions and simplify preliminary tax liability calculations.

Example: EY is experimenting with a Generative AI system to answer complex payroll tax questions, particularly for employees located overseas. This tool draws on a vast database of laws, improving response time and accuracy compared to relying solely on human experts.

- Prepare reports and related footnotes. AI-powered algorithms can generate factual and comprehensive financial summaries, assemble detailed income and cash flow statements or balance sheets, ensuring precision and saving time.

- Conversational finance. Generative components enhance the capabilities of chatbots and virtual assistants. By understanding nuances and context, AI ensures smoother, more relevant interactions for customers and teams alike, leading to a better overall user experience.

Example: PwC New Zealand has deployed a custom Generative AI chatbot called ChatPwC. It provides a secure environment for employees to ask text-based questions, enabling them to access information quickly and focus on higher-value tasks.

- Simplify bookkeeping. Companies can automate tedious duties like data entry, invoice processing, and account reconciliation, freeing up resources for strategic analysis.

- Audit automation. Such systems are able to streamline audits by quickly ingesting and analyzing massive datasets and pinpointing unusual patterns or discrepancies, enabling auditors to work more efficiently and identify potential risks with greater accuracy.

Example: Deloitte has developed an internal Gen AI chatbot called DARTbot. It serves as a virtual assistant for their audit & assurance professionals, providing real-time guidance, answering complex accounting questions, and supporting daily tasks.

Generative AI is still evolving, but its prospects within the field are undeniable. As language models become more sophisticated, we can expect even broader and more innovative applications.

Unlock Business Advantages with Gen AI in Accounting

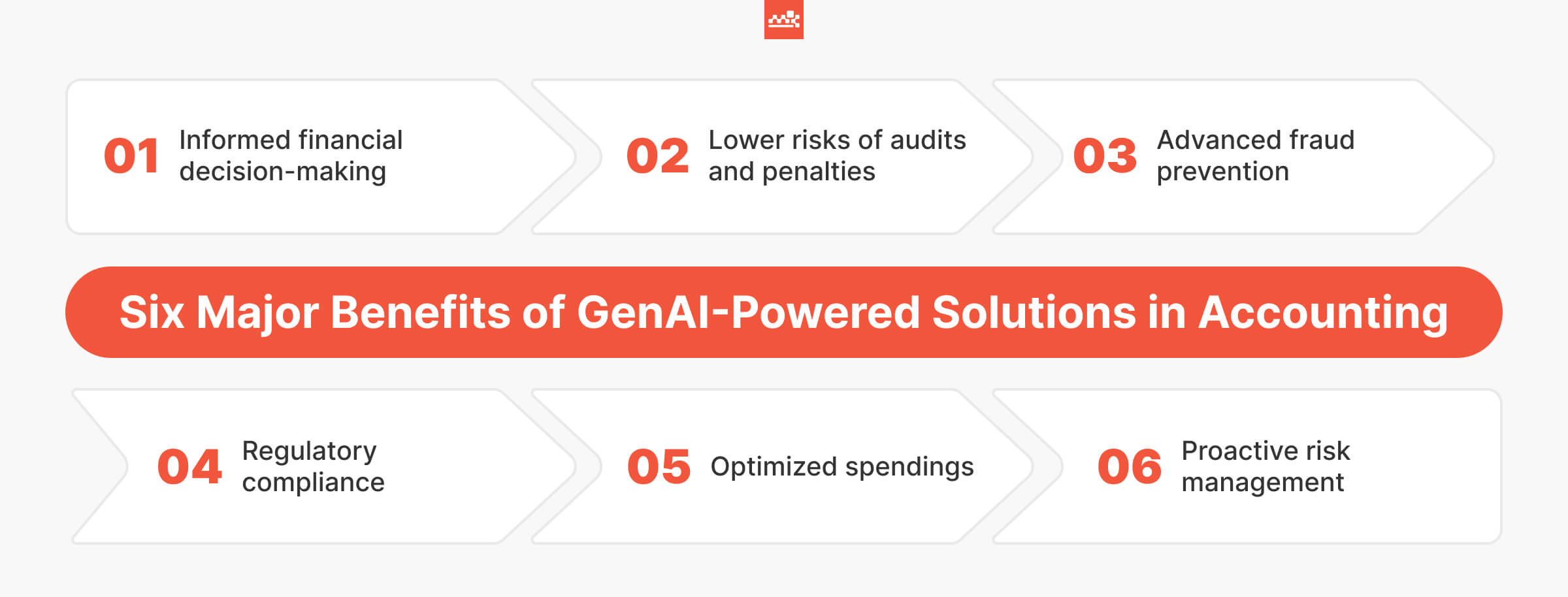

Beyond mere automation, artificial intelligence can transform accounting practices in multiple ways. According to an ACCA survey, embracing digital tools can yield numerous organizational gains including:

- Increased flexibility and elevated quality of services (78%)

- Improved sustainability, transparency, and regulatory compliance (72%)

- Enhanced efficiency and streamlined internal processes (52%)

Here’s a deeper look at the major advantages of Generative AI:

- Ensures regulatory compliance by staying up-to-date on the latest changes to laws while minimizing the risk of audits and costly penalties.

- Frees up valuable time for forecasting, client communication, and analysis.

- Reveals overlooked trends and provides customized data analytics, empowering data-informed financial choices.

- Helps businesses understand their financial health and make proactive decisions.

- Enhances fraud detection by flagging unusual transactions or anomalies that might escape human attention.

- Mitigate potential threats proactively and optimize spending through vendor performance assessments.

Overall, Gen AI introduces a powerful toolkit for accountants to streamline processes, reduce costs, enhance accuracy, and drive better business outcomes.

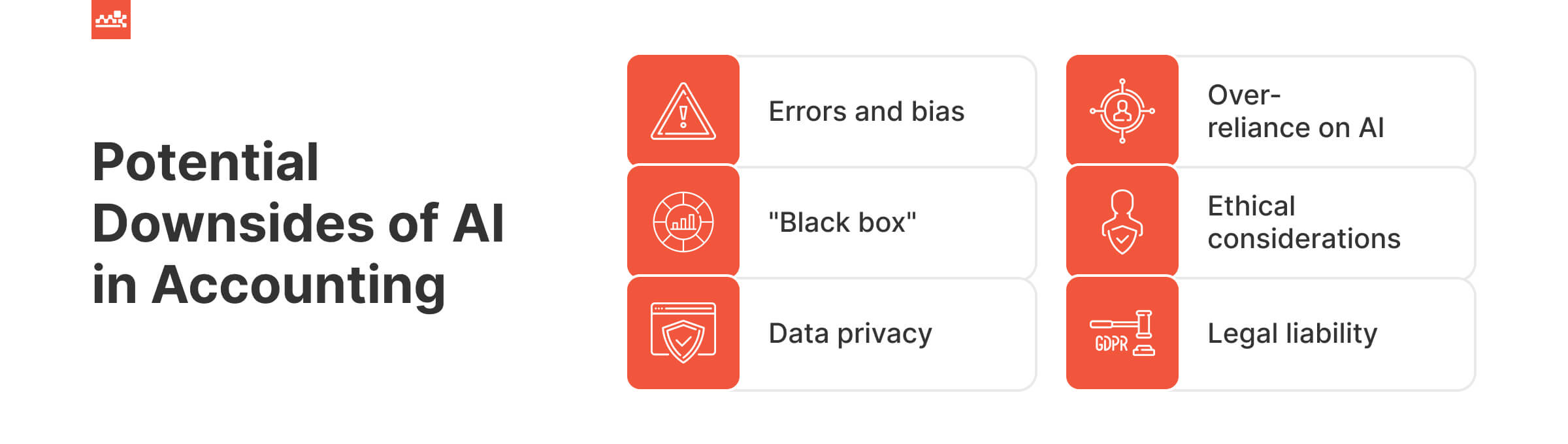

Responsible Artificial Intelligence: Addressing Limitations in Accounting

To fully realize the listed gains, firms and teams must also look critically at the limitations of large language models that require careful consideration.

Potential for Errors and Bias

Any flaws or prejudices in the training data will be reflected in the model’s outputs. This can lead to inaccurate financial reports, discriminatory recommendations, and poor decision-making. Accounting teams need to carefully curate the datasets and implement bias detection tools, engaging in ongoing review and testing of the provided answers.

“Black Box” Problem

With Generative AI in finance, the lack of transparency in reasoning processes can hinder trust and make it harder to locate potential errors. Businesses should opt for explainable models where possible and encourage critical evaluation of outputs alongside accountants’ professional judgment.

Data Privacy and Security

Accounting involves highly sensitive financial records, so breaches or unauthorized access have severe consequences for businesses and customers. To handle this, companies should implement robust cybersecurity protocols, prioritize encryption, conduct regular security audits, and train employees on data handling and incident response.

Over-Reliance on Technology

Overdependence on AI can lead to complacency and a decline in accountants’ critical thinking skills. Therefore, it’s vital to establish a balanced approach where the generative model is a powerful tool, not a replacement for human expertise.

Ethical Considerations

Concerns are raised around systems’ potential use for deception or manipulation. These challenges can be handled by developing clear ethical guidelines and policies regarding the application of Generative AI in accounting and maintaining human oversight for sensitive outputs.

Legal Liability

It’s unclear who bears responsibility in the event of errors, fraud, or misconduct involving Gen AI systems. Thus, it’s paramount to proactively address legal concerns by developing contracts that clearly outline liability. Plus, teams should stay up-to-date on evolving regulations in this area to mitigate arising risks.

Wrapping Up

Generative AI is rapidly transforming accounting practices. At the same time, while this technology offers immense potential, its successful integration in this highly regulated field demands informed decision-making.

Here’s a list of essential tips and tricks to help you navigate the landscape:

- Focus on well-defined tasks for initial implementation.

- Prioritize data quality for optimal output.

- Review and refine the model’s answers for accuracy and relevance.

- Choose a transparent system for trust and error detection.

- Monitor and benchmark generated content against human work.

- Employ artificial intelligence for efficiency and maintain accountants’ expertise for strategy.

By adhering to these recommendations, you balance the benefits of Gen AI with responsible risk mitigation. This is crucial as intelligent solutions continue to evolve, and more sophisticated accounting-specific models are on the horizon. Don’t hesitate to reach out to Master of Code Global for personalized advice and guidance on how to best leverage Generative AI within your unique business context.

Don’t miss out on the opportunity to see how Generative AI can revolutionize your accounting services, boost ROI, and improve efficiency.