Contact centers are the front line of customer interaction. While essential, they face numerous challenges, from long wait times to repetitive queries. This is where call center automation steps in, promising to revolutionize the client experience and streamline operations.

Artificial intelligence has emerged as a game-changer in the field. Chatbots, powered by AI, can handle routine inquiries and provide 24/7 support, freeing up agents to focus on complex issues. Nearly 60% of customer service professionals say the technology has saved them time. However, AI-driven automation extends far beyond just conversational solutions:

- Interactive Voice Response (IVR): These systems use pre-recorded menus and voice recognition to route customers to the right department, reducing reliance on human operators.

- Intelligent Call Routing: Advanced systems analyze data and intent to connect users with the most suitable agent, improving first-call resolution rates.

- Speech Analytics: AI-powered tools can analyze recordings to extract valuable insights, identify trends, and improve agent performance.

In this article, we’ll dive deeper into the exciting world of AI-driven call center automation, exploring its benefits, various technologies, and practical implementation strategies. We will also discuss call center experience with voice agent. Read to the end to find out how not to make a mistake while choosing your dedicated AI services provider.

Table of Contents

What is Call Center Automation?

Embracing the transformative power of technology, modern businesses are increasingly turning to automation solutions to streamline operations and elevate client service standards. Contact center automation means using AI and machine learning algorithms to handle tasks that would usually be done by human agents. This includes things like answering simple questions (with chatbots or IVR systems), routing calls to the relevant specialists, scheduling appointments, and even analyzing call recordings. The goal is to make contact centers more efficient, save money, and give customers a better experience.

Value of Integrating Conversational AI Solutions for Call Center Automation

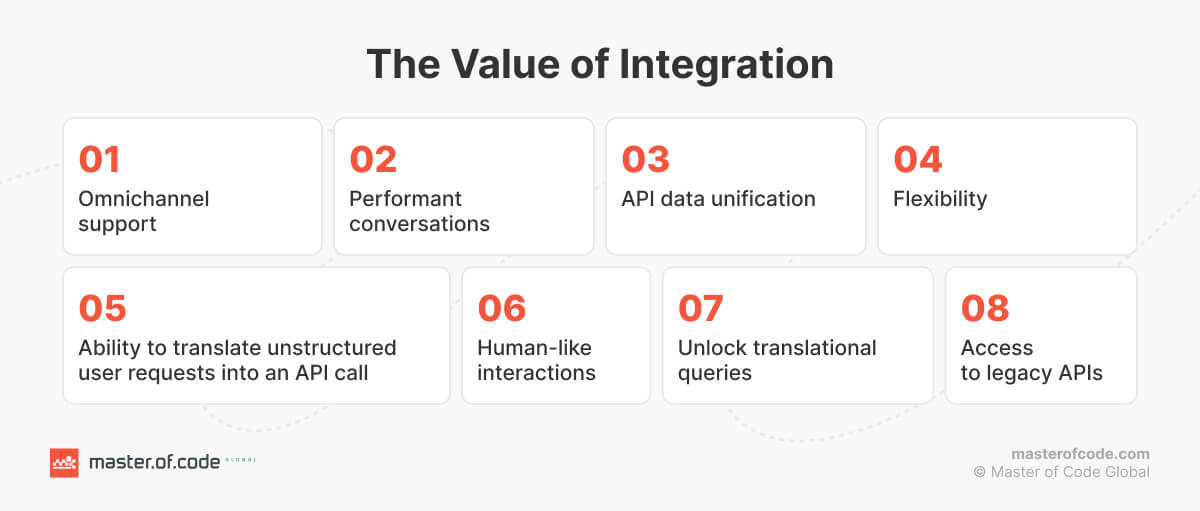

Whether it is the channel itself, a workforce management tool, NLU or other cognitive systems, we cannot deny the importance of integrations. According to the statistics, Conversational AI deployments in contact centers will lower agent labor costs by $80 billion by 2026. Let’s explore the key features and benefits of integrating Conversational AI Solutions for call center automation. By leveraging these technologies, businesses can enhance customer service efficiency and streamline interactions, ultimately improving overall satisfaction.

Read more: Use Cases of Generative AI for Call Center

Omnichannel support allows the bot to work alongside any channel and over multiple communication methods. With the release of a new channel, enterprises simply need to adapt the user experience using established workflows. But if the conversational platform does not hold it up, it’s important to check how the system is set up on that channel.

Integrating makes conversations better because the information can be shared in a casual way. When we give info like a real person does with Conversational AI, it makes the experience smoother. Our company is not just helping clients directly, but finding the best solution for their problem.

API data unification allows enterprises to bring all of the data points together into a coherent message. Letting a bot handle the interpretation allows for a more probabilistic understanding of the request. Companies may get some data from CRM, an inventory system authentication, SSO platform or directly from a database. Knowing where the data comes from helps firms create a seamless experience and organize information in a user-friendly manner.

Some other benefits of contact center automation:

- Improved customer & employee satisfaction: AI-powered tools can provide personalized maintenance, resolving issues faster and reducing frustration for both clients and agents.

- Increased metrics: Technology integration leads to higher first-call resolution (FCR) rates, shorter average handle times, and improved overall contentment scores.

- Reduced costs: Automating routine tasks frees up workers for higher-value interactions and decreases overall operational expenses.

- 24/7, omnichannel, multilingual support: You get round-the-clock availability across multiple channels (phone, on-website chat, email) in various languages, expanding service accessibility and improving clients’ path.

Types of Call Center Automation

- Scheduling Calls. Mechanizes appointment scheduling and reminder systems, reducing missed calls and optimizing agent schedules.

- Automated Interactions with Clients. Utilizes AI chatbots and Interactive Voice Response (IVR) for 24/7 maintenance, handling routine inquiries and routing calls.

- Sales and Marketing. Streamlines lead generation, consumer follow-ups, and promotional campaigns across phone and digital channels.

- Data Collection and Forecasting. AI-powered tools analyze call data for volume prediction, staffing optimization, and trend identification.

- Virtual Queuing. Manages call queues intelligently, offering callbacks and virtual waiting to improve caller experience.

- Workflow Operations. Deals with repetitive manual tasks like data entry, case creation, and follow-ups.

- Notifications. Trigger automated appointment reminders, status updates, and satisfaction surveys via text or email.

- Synchronization Across Multiple Apps. Integrates with existing systems for a seamless data flow.

- Customer Outreach. Streamlines excel campaigns through targeted messaging and follow-up strategies.

- SMS Automation. Deals with outbound messaging campaigns for promotions, notifications, and reminders.

- Auto Dialers. Efficiently manage outbound calls, increasing agent productivity and campaign reach.

- Live-Agent AI Support. Provides workers with real-time suggestions and insights, improving call resolution and consumer journey.

Current Trends in Call Center Automation

Today, 49% of businesses polled said they use contact center software or a knowledge base. However, that number will increase over the next two years, with 24% of organizations planning to adopt the technology. Call center automation is constantly evolving, and several exciting trends are shaping its future:

Hyper-Personalization: AI-powered tools will increasingly analyze customer data, preferences, and behaviors to provide highly tailored experiences. This means understanding client intent and offering proactive solutions, driving higher user pleasure. Deloitte reports that 90% of people are attracted to hyper-personalized advertising content.

Omnichannel Integration: Automation will seamlessly connect phone, chat, email, and social media channels for a unified consumer journey. People expect to switch between preferred messengers without losing context, this way driving consistency.

Conversational AI: Chatbots and IVR systems will move beyond simple scripts to become truly conversational. Natural language processing advancements will also enable more meaningful, human-like interactions.

Agent Empowerment: AI will augment human agents rather than replace them. Real-time suggestions, knowledge base access, and sentiment analysis tools will help workers provide exceptional support. Deloitte’s Global Contact Center Survey revealed that 79% of contact center leaders plan to invest in greater AI capabilities in the following years.

Predictive Analytics: By analyzing all the recorded data from users’ interactions with support, AI will help forecast call volumes, identify problem areas, and optimize staffing proactively. This leads to a more efficient and responsive call center.

These trends emphasize the shift towards providing context-aware, personalized maintenance across multiple channels. The goal here is to elevate both the client and agent journey, fostering loyalty and optimizing resources.

Challenges You Can Face Dealing With Contact Center Automation

The integration of advanced technologies has become a strategy for the leading Conversational AI companies striving to meet growing consumer demands and expectations. However, while call center automation brings significant benefits, it also poses some challenges that need careful consideration:

- Balance Between Human and AI Automation: Finding the right proportions of automation and human touch is key. Over-reliance on even the smartest technology can lead to a frustrating customer experience, especially when dealing with complex issues or emotions. The goal should be to leverage AI for efficiency while preserving the human aspect for empathy and nuanced problem-solving.

- Employee Concerns: Call center process automation can create anxieties among staff who may fear job loss. Transparent communication and upskilling initiatives are crucial. Emphasize that AI aims to augment agents by taking on repetitive tasks, freeing them for higher-value interactions and ultimately improving job satisfaction.

- Data Quality and Bias: AI models are only as good as the data they’re trained on. Incomplete data can lead to inaccurate or discriminatory outputs. Rigorous data governance and bias mitigation strategies are essential for building trustworthy systems.

- Technical Complexity: Integrating various automation tools and ensuring seamless transitions between AI and human can be technically complex. Expertise and careful planning are crucial for successful implementation.

Addressing these challenges requires a strategic approach that prioritizes ethical development, clear communication between employees and your dedicated service provider. Continuous evaluation is also essential to refine the balance between real-time automation for call centers and human connection.

Top Conversational AI Channels And Types For Customer Engagement

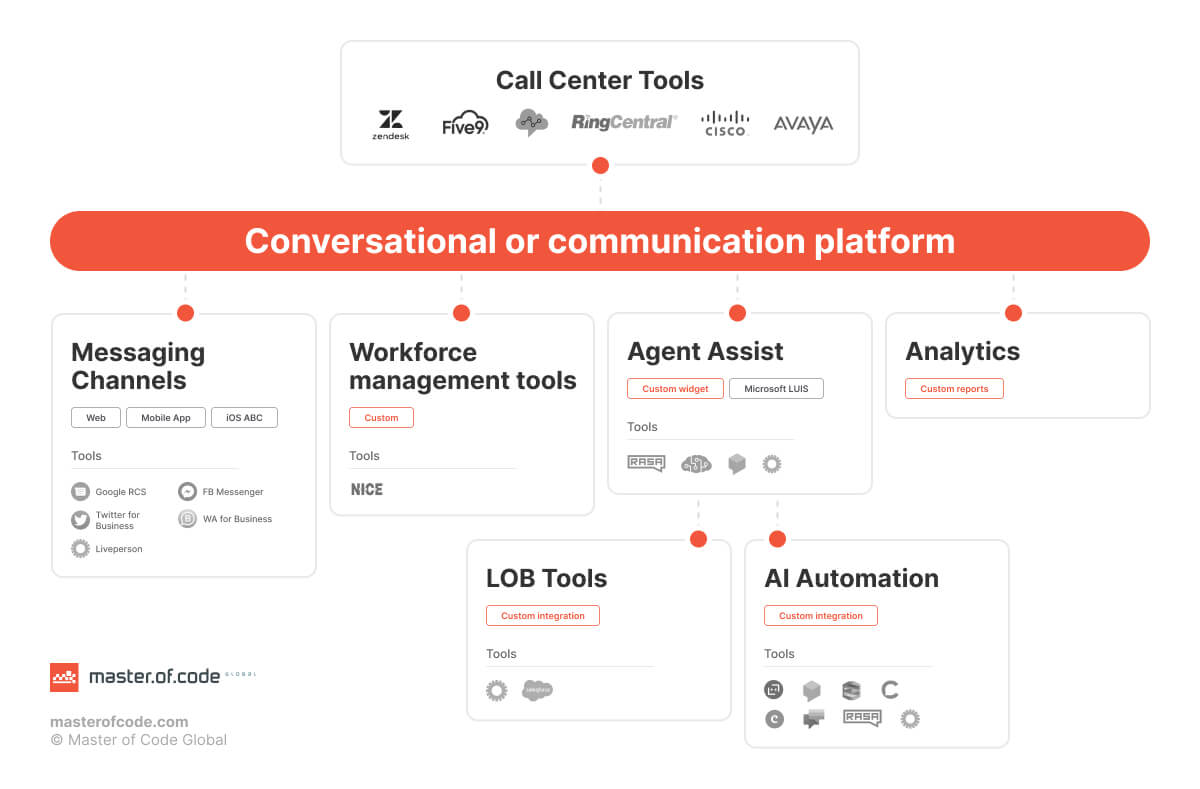

When making the decision of how you want to engage people, identification of the most applicable channels and conversational types is a must. It can be implemented by adding a bot to your website, or through existing digital support channels, such as Apple Messages for Business, Facebook Messenger, or Microsoft Teams. Also, it can be a replacement of a basic phone system such as a tone-based IVR system with a Conversational AI-based one.

Channels and communication methodologies drive the use case priority and provide a foundation for measuring success. Since each channel offers different ways of user engagement, strong knowledge of its specification and capabilities is key to creating optimal experience. This selection, which can grow as your needs change, is one of the fundamental pieces that can drive digital engagement for your brand.

Workforce management tools allow performing some agent planning, but also understanding how to accurately route a customer to the appropriate live agent. The faster any solution can give an answer to the user, the more efficient the process is.

Agent assist. Useful in determining the clients’ need and finding the right specialist or workflow to process the request.

Menu-driven navigating systems can be low-cost to implement, but also create a much more linear process as well as provide limited metrics. As a result, you might know how many people follow a certain path, but you don’t necessarily get insight into what else they expect from your chatbot.

Bots for analytics. By transforming a basic experience to a Conversational AI flow, the amount of data you get increases dramatically. You will see what people want to do, identify new flows and user journeys, as well as have data-centric metrics to maintain your growth decisions.

In addition, you can add in an NLP solution, either a cloud-based or an on-prem one. Based on organizational needs, it’s possible to fine-tune that experience to flow in a way that is virtually seamless to the end-user.

It is important to select a tool for contact center automation based on your business needs, such as supported languages, PII concerns, and technological constraints caused by limitations.

Finding the right NLP to manage, understanding and training for your call center automation is a core priority. And this can extend further into other AI automation components such as sentiment analysis, document processing, visual recognition, and other cognitive services. Having a long term strategy helps with the right selection, and can save time and money down the road.

Additionally, we cannot forget the line of business tools that house the detailed data that is needed to make the conversation helpful to end-users. This is where customers can authenticate themselves, perform appropriate tasks, and access CRM, ERP, or other operational services to allow a live agent to engage and answer user questions. As a bot gets more access to information, its value continues to increase, resulting in clients who can obtain assistance much more quickly.

The Conversational AI approach is much more natural, and the more we make it human-like, the more users will engage and perform actions without the need for a live agent. Building that trust that a Conversational AI solution can answer those questions is key.

Implementing a Conversational AI Experience Within a Call Center

There are a few fundamental components that must exist, beginning with call center tools that are implemented for an organization. There is no one right or wrong option, simply what works best for your organization. All of the major solutions, Cisco – RingCentral, Zendesk, and many more – bring value to creating that contact center automation journey. They enable consumers to enter into the queue to engage with live workers.

Master of Code Global succeeds in revolutionizing experiences by seamlessly integrating Conversational AI. Our expertise extends to crafting bespoke solutions, ensuring personalized customer interactions. Leveraging cutting-edge technology, we create tailored Conversational AI experiences, enhancing efficiency and satisfaction. Due to our innovative approach, Master of Code Global delivers a lot of custom solutions, making call center operations especially advanced and convenient.

Opportunities For Call Center Automation With Conversational AI

Working with a conversational platform allows tying the live agent component to the automation piece in a much more simple fashion. In many cases, these automated call center solutions have a conversational element, either pre-built or with partnerships that can be leveraged. Otherwise, two systems could talk to one another via existing APIs or through custom integrations that can be developed.

The main value propositions for businesses here will be the following:

- Decreased number of repetitive requests to agents, by answering easy questions.

- Reduced wait times for users, resulting in much more favorable agent stats.

- A high level of conversational automation which ensure feature-rich interactions and satisfying experiences.

Real Examples Of Contact Center Automation Usage

In the realm of customer service enhancement, many factors contribute to streamlining operations and elevating satisfaction levels with AI integration:

- Budget limitation

- Market share

- Number of employees

- Client preferences

- Market competition

For example, AT&T company employs contact center automation to handle inquiries, technical support, and billing issues. Large retail chain Target utilizes automation in its consumer service centers to handle order tracking, returns, and general inquiries. Finally, Apple, one of the biggest tech companies, incorporates automation into the support systems to provide assistance with product troubleshooting, software updates, and account management.

Master of Code developed an Apple Business chatbot to tackle the challenges faced by the client in managing international customer support teams situated across various time zones. This solution enables seamless management of employee workload by analyzing staff availability and geographical location. The chatbot intelligently directs queries to active agents or escalates them to a specialized group based on real-time data.

How To Choose the Right Technology for Your Automated Call Center?

The selection of appropriate AI-driven tools stands as a pivotal decision, wielding the potential to revolutionize operational efficiency, elevate customer experiences, and bolster overall organizational success.

Choosing the right Conversational AI for contact center is crucial for a successful implementation. In general, for every industry and field, it takes multiple technologies and multiple systems to create an effective solution. Bringing those systems together is something that Master of Code has experience in delivering, which lets us be recognized as a trusted partner by some significant providers of Conversational AI solutions in the market, including Amazon and Microsoft.

We work with many platforms based on client needs and selected solutions, have the knowledge and skill to create Conversational AI experiences within an existing platform to optimize it, not just for a cloud deliverable. This allows us to understand what works and what doesn’t to provide recommendations and guidance throughout the lifecycle of the engagement.

Here’s a breakdown of what MOCG provides:

- Real-Time Call Analytics: Opt for a service that offers in-depth analytics of call interactions. Look for features like sentiment analysis, keyword spotting, and trend identification to gain actionable insights into people’s needs and pain points.

- Integrations With Existing Software: Seamless integration with your CRM, helpdesk, and other systems is essential. This ensures a unified data flow, allowing AI to leverage existing information and streamline workflows.

- Automatic Survey Generation: Choose a solution that can automatically trigger client satisfaction surveys after interactions. This provides valuable feedback on chatbot performance and areas for improvement.

- Integrate Powerful Analytics: Go beyond basic reporting. Look for robust analytics dashboards that help you track key metrics, measure ROI, and identify trends.

- Real-Time Quality Management: Services that offer round-the-clock monitoring of AI-human conversations are invaluable. This allows supervisors to identify areas where the technology may need refinement and provide targeted maintenance to agents.

Additionally, consider factors like vendor support, scalability, security, and ease of use. Start by clearly defining your specific call center needs and pain points. Master Of Code Global will help you choose the technology that best aligns with your goals and tell you everything about Conversational AI in customer support. You can look at our portfolio where we deliver amazing experiences for companies like Aveda, Verizon and T-Mobile.

Conclusion

Call center automation with AI is a pivotal step in transforming client experience and support. By strategically combining AI’s efficiency with the human touch, these helpdesks can achieve unprecedented levels of responsiveness, personalization, and cost-effectiveness. As the technology matures, the possibilities are endless. Investing in contact center automation is not just about staying competitive; it’s about future-proofing your business by prioritizing client experience at its core.

We analyze your customer pain points and address them with automation.

Get in touch

Get in touch