The banking industry is undergoing a dramatic transformation. Gone are the days of slow, impersonal financial services. Today’s customers expect a seamless, personalized experience that keeps up with their fast-paced lives. Traditional methods, heavily reliant on SMS and email, are struggling to meet these escalating demands.

While basic messaging boasts impressive open rates, its limitations are clear. Text-based formats simply can’t deliver the rich, interactive approaches people crave. It’s like trying to enjoy a gourmet meal through a paper menu. The potential for real-time, engaging communication exists, but good old channels fall short of realizing it. That’s where RCS in banking comes into play.

This advanced messaging standard enables financial institutions to deliver visually appealing letters, complete with high-quality images, videos, and responsive elements. By leveraging this technology, banks can create seamless, omnichannel interactions that resonate with users and drive engagement. The statistics say that the advanced messaging market is expected to reach $19.48 billion by 2028.

Master of Code Global is at the forefront of RCS implementation, offering expertise in harnessing the power of this technology to transform finance operations. Our solutions empower banks to deliver exceptional consultancy, increase efficiency, and gain a competitive edge. Curious to know how exactly we do this? Read to the end to discover the opportunities this technology holds for your sector.

Table of Contents

Understanding RCS and its Potential in Banking

Rich Communication Services is the evolution of SMS, offering a more interactive and visually appealing platform. Beyond simple text-based messages, rich services allow for the integration of diverse media, including images, videos, and audio. Its features, such as buttons, carousels, and forms, enable businesses to foster dynamic and engaging chats. 89% of consumers have expressed a desire for two-way conversations with companies via messaging channels and apps.

Unlike traditional SMS, which is limited in its capabilities, RCS messaging offers a significant upgrade. Businesses can enhance their brand identity through visually appealing messages, making a stronger impression on clients. Interactive elements allow for direct satisfaction, transforming one-way communication into a dynamic conversation. Additionally, you are equipped with features like read receipts and typing indicators, which improve dialogue efficiency and provide valuable insights.

Enhanced Customer Engagement

RCS is the secret weapon for winning over the new audience. By ditching dull text for eye-catching visuals, banks can turn ordinary messages into unforgettable chat. Rich communication lets you tailor every message to each client, making them feel like a VIP. It’s similar to having a personal assistant who knows exactly what to say to make your users smile.

Improved Customer Service

Client support just got a major upgrade. RCS in banking is transforming the way organizations interact with people. You can leave endless hold times and frustrating automated systems behind. Now banks can offer real-time help, visual explanations, and self-service options that empower users. Rich media messages see a rapid open rate of 90% within the first 15 minutes, while enhanced content holds consumer attention for up to 45 seconds.

Increased Operational Efficiency

Say goodbye to banking boredom. RCS turns everyday financial tasks into a breeze. Need to check your balance? Just tap a button. Want to confirm a payment? It’s a snap. Rich communication services automate the mundane, so you can focus on what really matters. Plus, you’ll spend less time on hold and more time enjoying life.

Boosted Marketing Effectiveness

Rich services are the secret weapon for marketers. Forget annoying text blasts; now you create campaigns that pop! With engaging multimedia, you can capture attention and drive customers to take action. It’s like having a personal advertising helper and advisor that not only delivers results but also gives you insights into what’s working. With RCS in marketing, you’re not just sending messages; you’re creating experiences that the audience loves.

Use Cases of RCS in Banking

Multimedia content offers a wealth of opportunities for financial businesses to elevate client experiences, improve operational efficiency, and drive growth. Let’s explore some RCS messaging examples across different areas of the sector.

Account Management & Customer Service

- Balance inquiries, transaction history, statement delivery: RCS enables banks to send clear, concise, and visually appealing budget updates, purchase summaries, and statements directly to smartphones. Interactive elements like buttons can allow users to quickly view specific banking transactions or download statements.

- Appointment scheduling, place locators: This feature allows businesses to let consumers easily book appointments at branches or with financial advisors. Additionally, enhanced messaging can provide real-time branch and ATM locations with maps and directions.

- Timely customer support via chatbots: Instant, personalized help to clients can be offered through channel-powered bots. For example, RCS in telecom can provide quick answers to common queries, resolve issues, and escalate complex problems to human agents seamlessly.

Marketing & Sales

- Personalized offers, promotions, and product recommendations: Rich communication unlocks the potential for banks to deepen relationships with customers with the help of multimedia. Interesting elements like carousels can showcase multiple product options, while rich media can highlight each item’s benefits.

- Interactive surveys and feedback collection: Want to know what your consumers really think? Banks can tap into the power of surveys and polls to conduct pulse checks and turn insights into action, driving audience’s satisfaction through the roof.

- Lead generation and nurturing: RCS is a client acquisition powerhouse. By sparking engaging conversations and using elements like forms, businesses can capture valuable information and effortlessly guide potential users through their buyer’s journey.

Payments & Transactions

- Secure payment initiation and confirmation: Say goodbye to transaction hassles. Interactive messaging offers a lightning-fast, secure way to send and receive money. Customers enjoy one-click convenience, and companies can provide real-time payment transparency.

- Fraud alerts and verification: RCS transforms scam warnings from scary notifications to helpful heroes. Clients can easily verify banking transactions or report suspicious activity through media options.

- Bill payment reminders: Forgotten receipts will not bother you anymore. Banks can send supercharged notifications with all the payment info people need, plus a simple click to finish the process. It’s still a bill to pay, but much more convenient.

Onboarding & Engagement

- Streamlined account opening processes: Experience setup reinvented. Engaging forms make providing information a breeze, while progress bars and status updates offer complete transparency. From now on, the account opening may be faster, easier, and more enjoyable.

- Personalized welcome messages and tutorials: According to the statistics, people are 35 times more likely to read an RCS message than email, especially when it’s multimedia. Tutorials and guided tours can help customers navigate online banking platforms on the go.

- Interactive onboarding journeys: The channel can be used to create enrollment path experiences that guide users through different stages of their financial relationship. You can incorporate gamification elements to make the process fun and engaging.

Overcoming Challenges & Ensuring Successful RCS Adoption

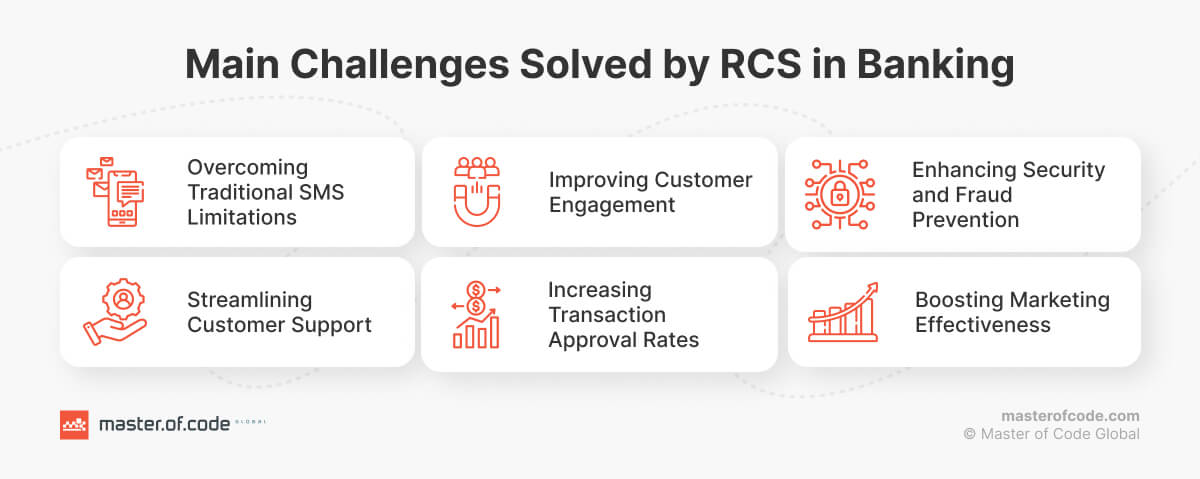

While advanced messaging offers immense potential for the banking industry, its implementation comes with certain hurdles. To ensure successful adoption, financial institutions must carefully address these obstacles and adopt a strategic approach.

One of the primary challenges is carrier support and network coverage. RCS is a relatively new technology, and the level of advocacy and coverage varies across different regions and service providers. Banks need to carefully evaluate the ecosystem in their target markets to ensure a seamless process.

Integrating Rich Communication Services with existing systems can also be complex. You may need to invest in new infrastructure or modify existing systems to accommodate channel functionalities. A well-planned integration strategy is crucial to avoid disruptions and ensure data security.

Finally, gaining client adoption and educating them about the benefits of RCS is essential. Users may be accustomed to traditional SMS and may require time to adapt to the new technology. Clear and concise communication about the advantages of interactive messaging is vital to encourage mass adoption.

To overcome these challenges and achieve success, we recommend banks to consider the following strategies:

- Partnering with an experienced RCS provider: Collaborating with a specialized company like Master of Code Global can expedite the implementation process and mitigate risks. Our expertise in the technology, and the finance industry in particular, can accelerate time-to-market and ensure optimal results.

- Developing a clear strategy and use cases: Defining a transparent approach aligned with business objectives is essential. Identifying specific use cases where RCS can deliver the most significant impact will help prioritize efforts and measure success.

- Prioritizing user experience and design: Creating engaging and user-friendly flow is crucial for customer adoption. Investing in professional conversation design and user journey will ensure that messages are visually appealing and easy to navigate.

- Measuring and analyzing RCS performance data: Tracking key outcome indicators (KPIs) is essential to evaluate the effectiveness of the technology campaigns. Analyzing data on message open rates, click-through rates, and client engagement will provide valuable insights for optimization.

The Future of RCS in Banking

The integration of artificial intelligence is poised to revolutionize client interactions, enabling advanced bots to deliver highly personalized financial advice, answer complex queries, and even assist with sophisticated transactions. For instance, AI-powered chatbots could analyze a customer’s spending patterns to suggest budget optimization strategies or recommend tailored investment options. Now 71% of consumers expect personalized contact with companies, emphasizing the importance of tailored communication.

Moreover, RCS is likely to become an integral part of the metaverse, offering an immersive process. Imagine virtual branches where users can interact with avatars of bank representatives, explore financial products in 3D, and even attend virtual workshops. It could foster deeper customer engagement and brand loyalty.

The convergence of RCS with other emerging technologies, such as blockchain and biometrics, will create new opportunities for secure and efficient finance services. For example, the channel could be used to verify a client’s identity through biometric authentication, enhancing security and streamlining processes. Additionally, blockchain technology can be integrated to provide transparent and immutable transaction records, building trust and confidence.

To stay ahead of the curve, banks must adopt a proactive approach to advanced messaging development. By investing in research and innovation, fostering partnerships with technology providers, and cultivating a culture of innovation, financial institutions can position themselves as leaders in the digital era. The future of the industry lies in leveraging such technologies to create seamless, personalized, and secure consumer experiences.

Conclusion

RCS is no ordinary upgrade; it’s a game-changer that’s rewriting the rules of the industry. By injecting personality, intuitive navigation, and visual appeal into every interaction, Rich Communication Services are transforming how banks connect with customers. From speedy support that feels like chatting with a friend to marketing campaigns that captivate and convert, the channel delivers results.

Businesses that embrace RCS can gain a significant competitive advantage by differentiating themselves through innovative and personalized interactions. Master of Code Global is a leading expert in implementation, offering tailored approaches to help banks unlock the full potential of this technology.

Make MOCG your partner in this exciting transformation! We help companies worldwide harness the full potential of Rich Communication Services, delivering tailored solutions that drive results. Ready to elevate your banking game? Let’s talk.

Ready to build your own Conversational AI solution? Let’s chat!