Think of a loan approval process that’s not only faster but also more insightful — where decisions are driven by artificial intelligence that can understand financial patterns better than ever before. That’s what Generative AI in lending is offering today. It’s not just about automation; it’s about seeing the entire credit lifecycle in a new light. Whether it’s spotting risks earlier or creating super-targeted offers, Gen AI is quietly becoming the strategic tool lenders didn’t know they needed.

Dive into our article to see how this technology could rethink your approach to the industry entirely. In this post, we’ll tackle the key questions that help demystify the evolving role of GAI in transforming banking practices.

Table of Contents

AI in Lending: Key Questions to Guide Your Decision

Our team gathered the most crucial FAQs that worry businesses, and now we are ready to share the answers with you. This guide will equip you with the knowledge you need to make thoughtful choices on incorporating AI into your operations.

Q1. Why should lending institutions invest in artificial intelligence now?

Lenders are at a crossroads where Gen AI has gone from being a high-end choice to a vital necessity. Customers now expect faster service, with 65% trusting technology to speed up processes, while 48% seek personalized interactions. Meanwhile, competition is heating up — 20% of financial organizations have already implemented at least one Generative AI application, with 60% planning to follow within the year. Thus, the question isn’t if, but when, you’ll make the leap.

Q2. What are the potential use cases?

Gen AI is increasingly being deployed across the credit lifecycle, with 58% of establishments using it for portfolio monitoring and early warning, 42% for applications, and 38% for underwriting.

Below are a few common scenarios where AI is making a difference in this domain:

- It rapidly examines borrowers’ requests, enabling quicker and more precise approval decisions.

- Underwriters rely on AI-driven insights to enhance risk assessments and support more informed choices.

- Smart algorithms monitor portfolios in real-time, providing early alerts for fraud prevention.

- Financial reporting becomes more efficient as AI automates data processing and document generation.

- Intelligentization streamlines compliance tasks by automating regulatory mapping to internal controls.

- Loan servicing is made simpler, with advanced systems managing inquiries, payments, and account updates.

- Self-learning tools analyze profiles and transaction histories to deliver ultra-customized deals.

These are only a handful of ways GAI is optimizing the sector, with even more possibilities arising as the technology matures.

Q3. What are the main advantages of adopting Generative AI in lending?

Artificial intelligence delivers broad benefits across industries. Businesses experience an 18% boost in customer satisfaction, productivity, and market share, with a $3.50 return for every $1 invested. Moreover, 77% saw an increase in leads and 71% created new products faster. Plus, GAI fuels revenue growth, with 70% of companies revealing higher earnings and 61% noting improved conversion rates.

In the lending field specifically, this technology is also having a noticeable effect. For example, AI-driven credit-risk memos increased income per relationship manager by 20%, while decisions became 30% faster. Some institutions have seen efficiency more than double as intelligentization enhances risk assessments and streamlines decision-making.

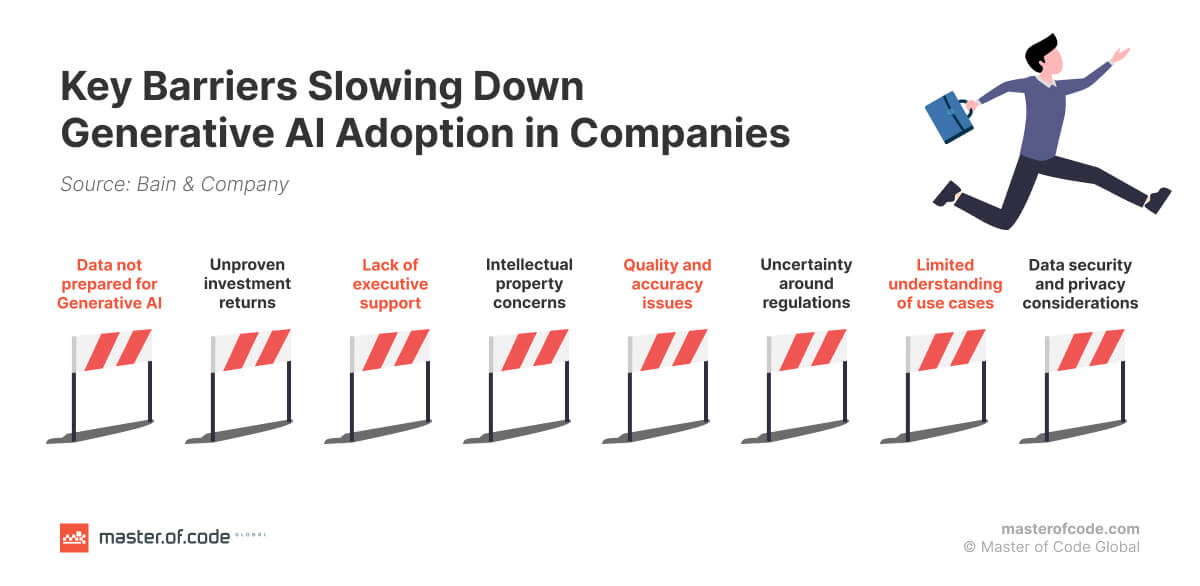

Q4. What are the key challenges and threats in adopting generative solutions in lending?

75% of respondents cited risk and governance as primary concerns for such implementations. Around half also pointed to difficulties in defining valuable use cases and quantifying the potential impact. The most common issue, noted by 79%, was data quality, followed closely by model-related problems like transparency, fairness, and explainability.

Overall, major vulnerabilities comprise:

- Algorithm biases that lead to unfair outcomes or misinterpretations.

- Intellectual property breaches, such as unintended copyright violations.

- Privacy matters arising from the usage of restricted or personal data.

- The possibility of generating harmful or misleading content.

- Security infringements that could expose sensitive systems to threats.

- Issues around model performance and clarity in decision-making.

- Risks associated with third-party data and proprietary information.

- Environmental and social impacts, including increased emissions or workforce disruptions.

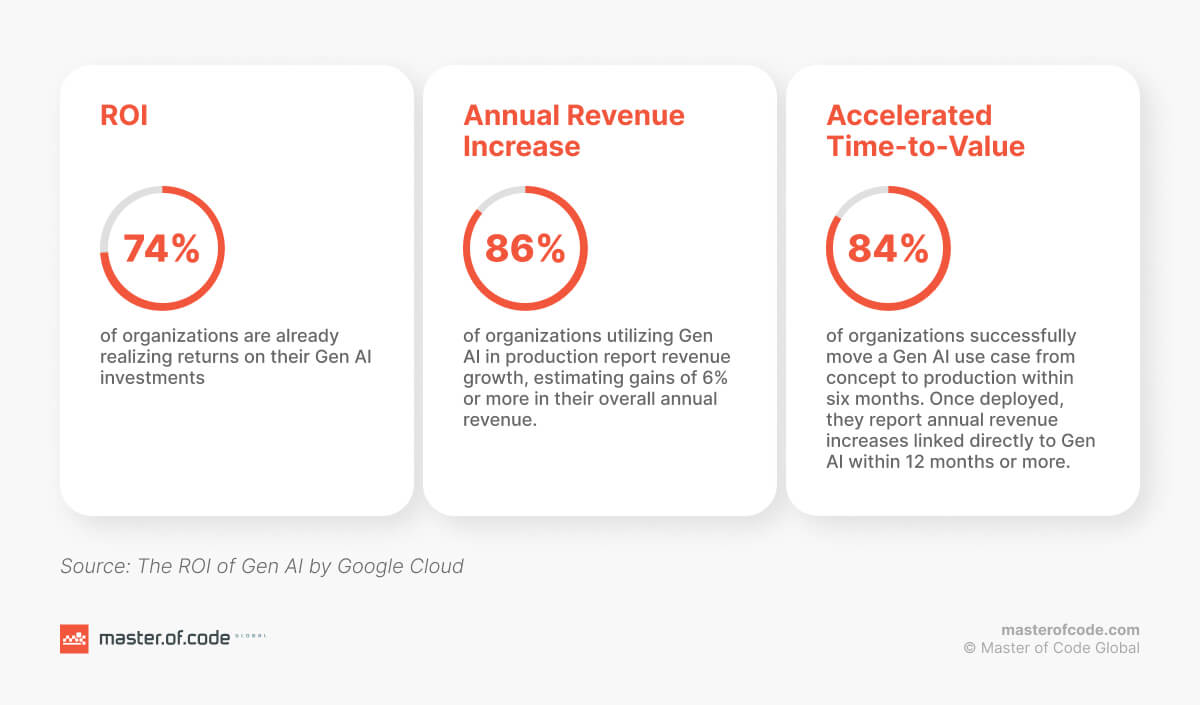

Q5. How can businesses ensure they get the best ROI from their AI funding?

Maximizing return on investment requires selecting high-value use cases, ensuring smooth integration with existing infrastructure, and continuously fine-tuning language models. Regularly revisiting strategy and investing in employee training also help unlock long-term benefits.

Q6. How does Generative AI transform the overall customer experience in lending?

This technology enhances the borrower’s journey by offering hyper-personalized loan options, reducing approval times, and automating support through conversational chatbots. It provides real-time insights, helping clients receive tailored financial products and frictionless service, boosting general satisfaction and engagement rates.

Q7. Is GAI scalable for both small and large lending institutions?

Absolutely. Generative models come in different sizes, each designed to address specific needs and budget constraints. Whether you’re a small bank seeking efficiency or a large institution aiming for advanced solutions, the right model can be selected to align with your objectives. An experienced tech partner will guide you through choosing the most suitable option.

Q8. How quickly can an organization see improvements after implementing artificial intelligence?

While full benefits may take 3 to 5 years to materialize, as indicated by two-thirds of surveyed executives, some organizations are already seeing significant returns. A few have attributed over 10% of their EBIT to Generative AI within a shorter time frame. Early results often depend on strategic implementation and prioritizing high-impact use cases, which can accelerate value realization.

Q9. How can lending companies ensure the successful deployment and scaling of generative applications?

Flawless rollout starts with a clear strategy, favoring scenarios that contribute to sustained success and reimagine entire workflows. Businesses must also invest in governance, performance infrastructure, and continuous innovation to support AI integration. Lastly, seamless collaboration between intelligent tools and human expertise is key. To achieve this, it’s essential to hire Generative AI developers with the experience to scale these solutions effectively.

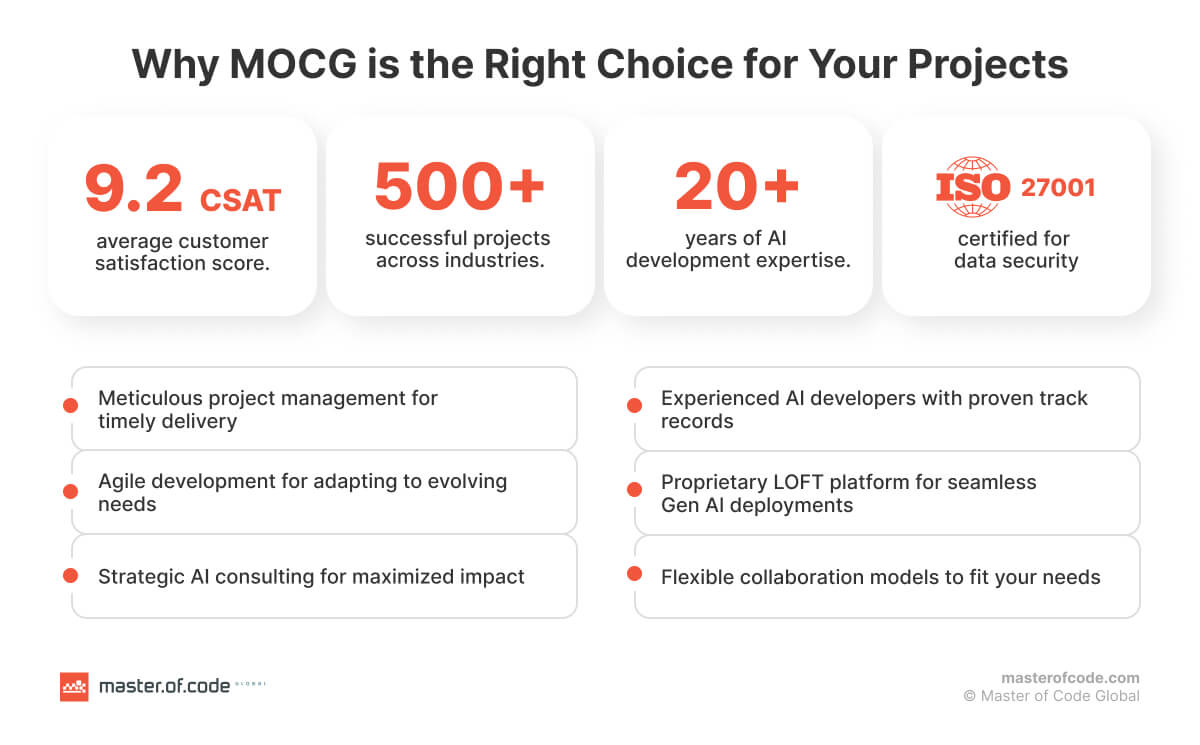

Q10. How do I select the right technology partner for the intelligentization initiatives?

When selecting a tech firm, it’s crucial to look for a background in AI development, a proven track record with scalable implementations, and a strong understanding of the sector. Confirm they offer tailored engineering and robust help for integration and ongoing maintenance. For instance, Master of Code Global stands out as a trusted partner for designing and building intelligent systems from scratch. Here is why.

Master of Code Global: Your Expert Partner in Implementing GAI in Lending

Our company specializes in Gen AI integration solutions, offering a full range of services from development to after-launch guidance. Our team customizes language models and advanced tools like GPT, DALL-E2, and PaLM2 to meet your specific needs. We guarantee smooth embedding into your current infrastructure, enabling scalability, flexibility, and enhanced operational efficiency. Our apps prioritize data privacy, compliance, and risk mitigation, providing a secure, reliable framework adapted to your specifications.

Ready to upgrade your lending processes? Join forces with our AI experts to deploy innovative generative solutions today and cultivate the customer experience of the future.

Ready to build your own Conversational AI solution? Let’s chat!